Blockchain solutionism (Lecture transcript)

This is a transcript of a guest lecture I gave at the University of Texas at Austin on September 21, 2022. This lecture was for a course in the School of Design and Creative Technologies called "Anti-Solutionism". There is also a Q&A portion at the end.

The recording is available on YouTube. The Google Slides are also publicly available (as well as embedded inline below as images).

I am Molly White. I’m a software engineer by trade… and by training, I guess. I also am a researcher and a writer. I have fairly recently—I suppose, the past year or so—gotten involved in researching cryptocurrencies, blockchains, this thing called “web3”, and all kinds of sort of related topics.

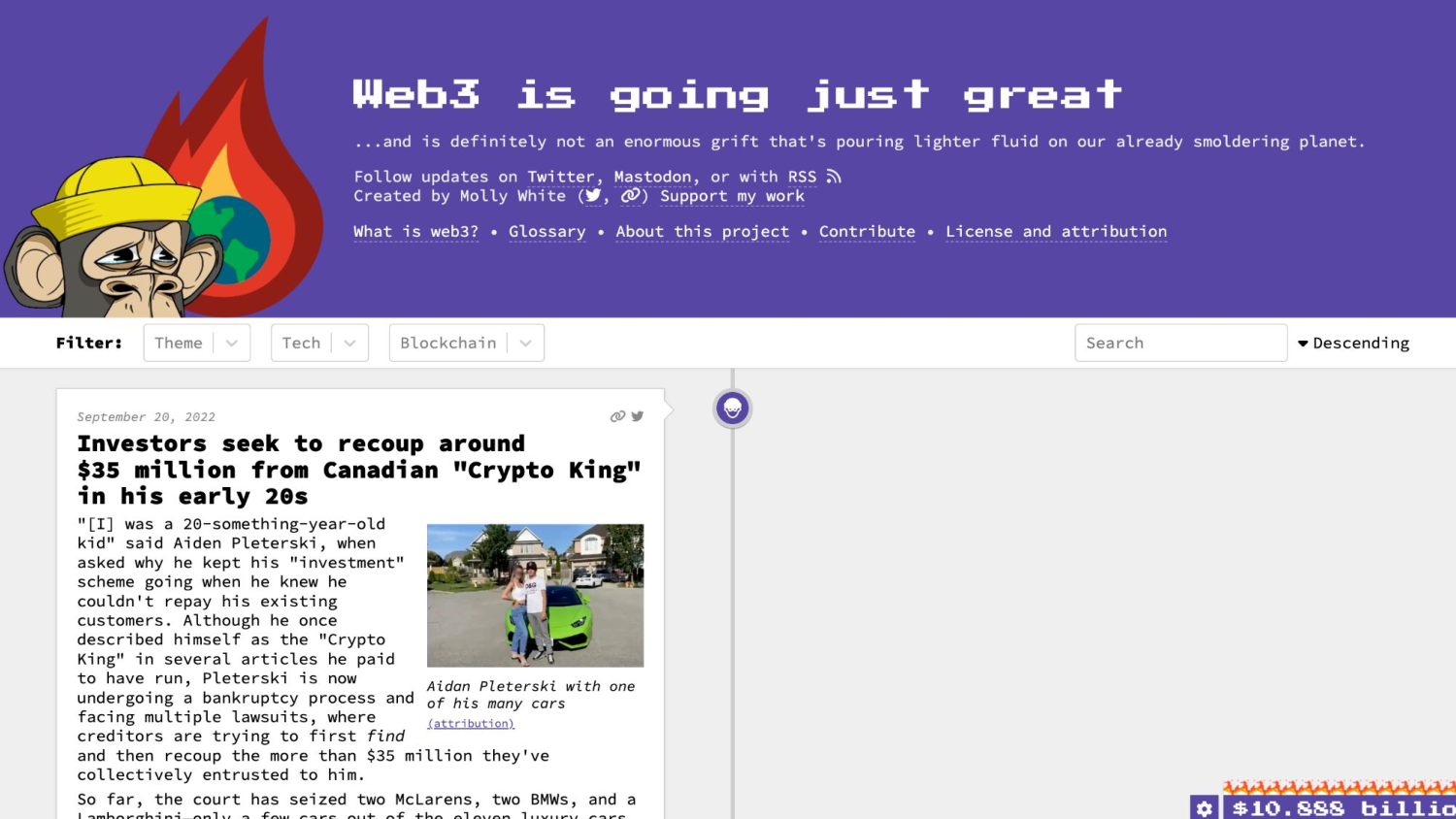

I run the website Web3 Is Going Just Great, which is a somewhat sarcastically named website where I keep track of a lot of the things that are really just not living up to the promises in web3 and crypto. It has a lot of examples of scams and hacks and just bad ideas that people are coming up with that they think crypto and blockchains are going to solve.

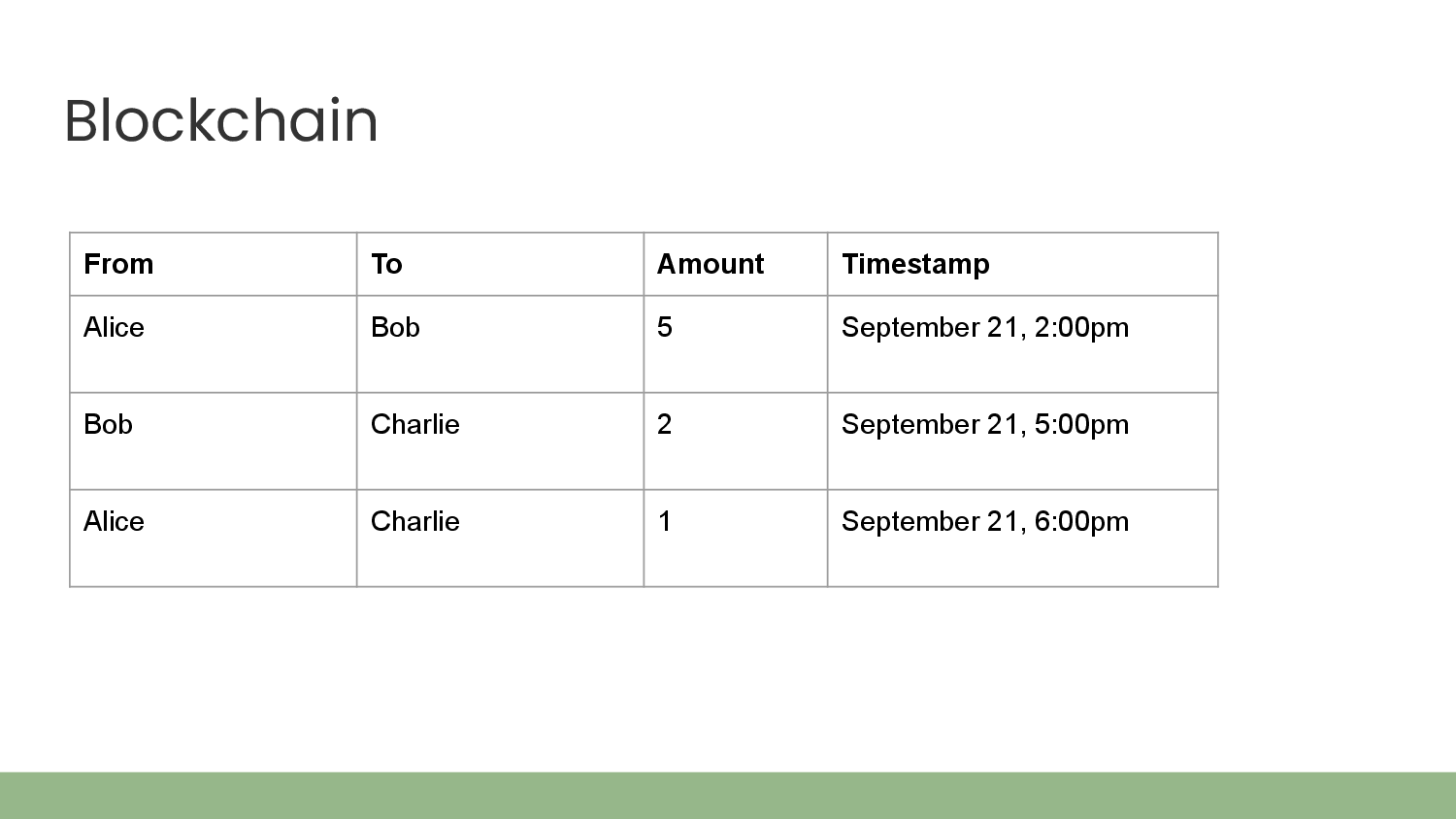

Before we get started, let’s go ahead and do just like a quick overview of what those words mean, because it can be a little difficult if we’re not all on the same page. I’m not going to get super technical, I know this isn’t a CS course, and it honestly is actually not that important to know the the super nitty gritty details of blockchains. But what you do need to know is that they are basically a ledger database that records transactions kind of like this. So you can think of it almost as if everyone had the record in their checkbook, and it was all sort of together. So yours was recorded along with, you know, your neighbor’s and everyone else’s and it was all in the same database and everyone could see it. So you could see, for example, in this example that Alice sends Bob five tokens. That depends on the chain what the actual token is called. And then maybe Bob sends Charlie two of those tokens, and then Alice is over there doing something herself. It basically keeps records of these transactions, but unlike with, say, your bank or with some other system, there isn’t one entity that’s controlling this record. So instead of your bank having a bunch of servers that record your monetary transactions, this is all a database that is maintained by hundreds or thousands of different computers that are all working together to keep this network online. And that’s a pretty difficult thing to do in computer science, and just in the world: getting a bunch of people that you don’t necessarily know or trust to all truthfully record the state of the system. You sort of get into this game theory problem of “okay, so we have all of these people who could all be bad actors, how do we convince them all to maintain this network and incentivize them against doing it?” All the solutions that people have come up with that are being used today for these blockchain solutions all involve, basically: someone has to spend or risk some amount of money in some way and then when they help to maintain the chain, they earn some money. So with Bitcoin, for example, which is one of the biggest cryptocurrencies, people have to spend money in the form of paying for electricity and for mining computers, and they are rewarded with Bitcoin when they maintain the network and verifiably add blocks to the chain. There are other systems, so Ethereum just notably moved away from the system that Bitcoin was using and they now have a system where people who have a certain amount of the token will stake that token and say “if I act badly,” you know, “if I do something that’s not in accordance with the network, you can just take away all my money” and so they are incentivized to not do that because they’re risking a lot of money. And they can earn money for, again, maintaining the chain. So that’s sort of the nuts and bolts of it.

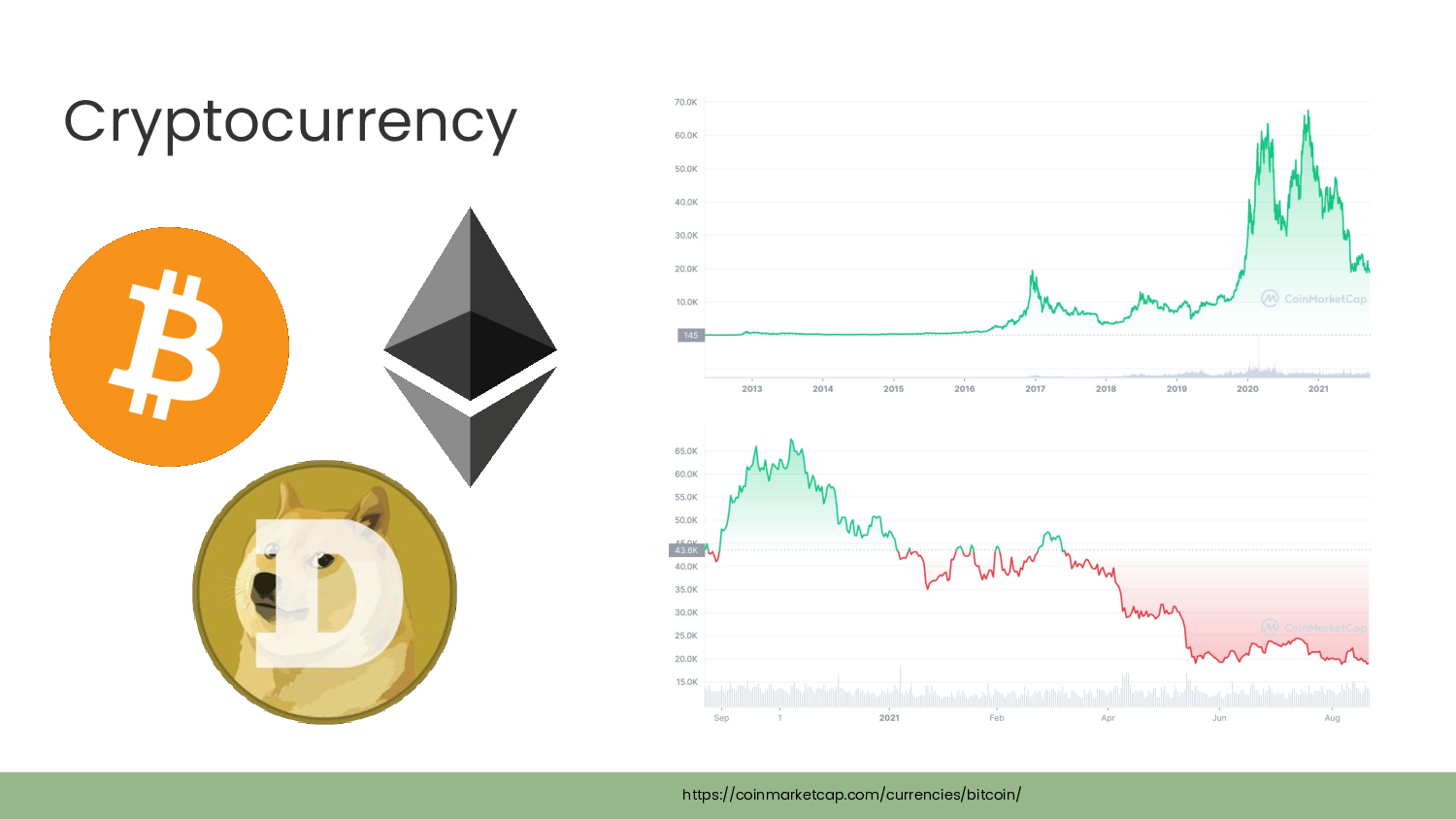

I referred a couple times to cryptocurrency. What’s that? So, Bitcoin, Ethereum, you’ve heard these words perhaps. Those are basically digital tokens that people believe is worth something. It’s not necessarily like other examples of currency where, you know, the US government is issuing it or any other state issues it. It’s basically just an online piece of data that people trade around. And if you have it, hopefully you can sell it to somebody else for around the same amount that you bought it for, or more, or potentially less. It’s named a little bit poorly. It’s not really a currency. The idea that a token that could be worth twice as much tomorrow, or half as much tomorrow, could actually function as a currency is pretty unusual. There’s a good example with Bitcoin, where in 2010 someone spent 10,000 Bitcoins—which at the time was worth around forty dollars—to buy two pizzas. If he’d held on to those tokens it could be worth $190 million today. At the all-time high it could have been worth more than half a billion. So if you think about, you know, US dollars, which is a traditional form of currency: if you had ten thousand dollars or forty dollars in 2010, you know there’s inflation… if you still had that forty dollars, it may not buy the same amount of pizza that it bought you in 2010, but it’s like pretty close, right? Like it’s not hundreds of millions of dollars different. And so the idea that this would function as currency is pretty flawed in the sense that currencies really just don’t work very well when they’re this volatile. It’s really more of something like an asset like a stock maybe, or a commodity. People will argue over what it really is, if it’s a security, a commodity, but it’s something a little bit more like that and you can think of it more along those lines. People will often buy and sell the cryptocurrency without necessarily getting involved in the mining, just for the purposes of speculation. They hope that tomorrow Bitcoin is going to be worth more than it is today, or in a year, or in 10 years, whichever it might be, and so they buy it and hold it for those purposes.

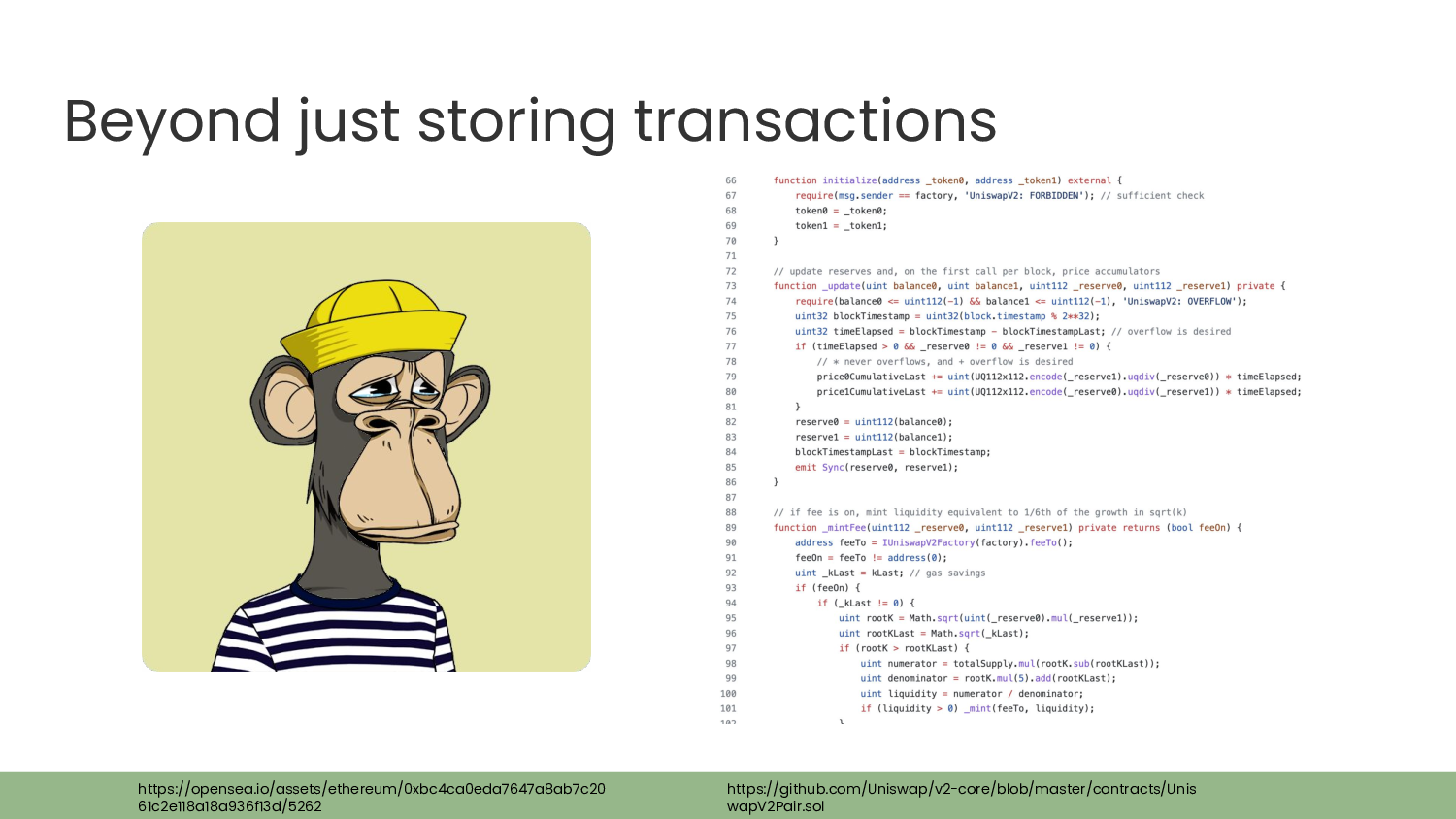

Blockchains also serve some additional functions in addition to just recording those transactions that are like the number of tokens that went from person A to person B. You can actually store data using the same sort of systems that store those transactions. You may have heard of NFTs. This picture is a Bored Ape, which is one of the most popular NFT projects these days. Those are bought and sold in very much the same ways as tokens—cryptocurrency tokens. There’s also smart contracts. So basically people will add code—they’ll write programs, upload them to the chain basically, and then people can interact with those programs without necessarily having to connect to your server or anything like that. So if you’ve heard of smart contracts or defi or any of these words, around basically programs that are being built on the blockchain, that’s what that refers to.

Which then brings us to the idea of web3, which is first and foremost a marketing term. And I think that’s important to remember. This slide here is from a “State of Crypto” report that was published by Andreessen Horowitz, which is one of the biggest venture capital firms and who think web3 is just the bee’s knees, and everyone should be buying and selling crypto, and, you know, creating these web3 projects. It’s a very effective marketing term, I will give them that. It’s based on the idea of web1 and web2, which are basically historical eras in the Internet and in the web, where, you know… we started with web1: most people who were using the web were just consuming information. They might not have a website of their own, but they were reading other people’s sites. It was very difficult to create a website of your own, you might have to actually own the hardware to do it, and it was kind of a pain. Then there was web2, which is what sometimes people will refer to as today’s Internet. This was where more people were actually adding things to the web, so social media posts and blogs and whatever else. You know, sharing your photos, things like that. People were sort of writing to the web in more of a substantial way. But it’s also the web where advertisers play a very big role, online privacy is not in a great state, I think lot of people would agree with that. And so there’s certainly flaws with it. So people start talking about, okay, so what’s the next one? What’s web3? And there have been a couple of different suggestions over the years for what web3 might be. In like the mid 2010s some people thought it might be this idea of the semantic web, which I’m not going to go to into in detail, but there were basically other suggestions for what web3 might be. I would say crypto has been the most successful in getting people to believe that web3 will be crypto and blockchains and all those kinds of things, but we are still operating in a web today that primarily is not using blockchains. And so it’s mostly just this prediction that maybe it will in the future and also, by the way, you should invest in these companies because this is the future of the web. So, that’s kind of the the goal around web3. But usually when people are referring to web3 they’re referring to web projects that use blockchains to some capacity, so it’s not necessarily just like people trading Bitcoin—that’s not really a web3 thing—but people who are actually building web projects that use these blockchains, you know like NFT marketplaces or social networks that are powered by blockchains in some way. Those are, and those tend to be referred to as web3. Alright, that’s out of the way. We are all on the same page. I hope you all understood that perfectly.

So, why? Why blockchains, why crypto? What’s the point of all of this? First of all, that’s a really great question. I think a lot of people were like, “okay web3…” like “that’s the next one!” And, you know, the number two goes to the number three, and so people have called this “web3”, that’s just gonna be the future of the web. But I think it’s important to think about why do you actually need a blockchain, right? What does a blockchain do that software that we use today doesn’t do?

There’s some pros and cons. I’m not a big crypto person, obviously, I’m a pretty strong critic of it. But there are things that it does that other software does not necessarily inherently do. The big two are censorship resistance—so if you are relying on a database that is owned and controlled by your bank or your Facebook or by your government, for example, they have a lot of control over what you can and cannot do. And so a bank might be able to say “sorry, we’re not going to serve you. You can’t have a bank account with us because we don’t like you for some reason.” Your government might be able to say “you’re a dissident, and so we are not going to allow you to do whatever it is that you wanted to do.” And Facebook can ban you. I mean, most people know this, you know, Facebook has the keys to the kingdom and so they can say “sorry, we don’t want you on our service for whatever reason. You’re no longer welcome here.” With crypto, that’s not really the case no one can say “hey you, you can’t use Ethereum.” Or “you can’t use Bitcoin”. And there are some ways that people try to enforce restrictions around sanctions on who can interact with various companies that are built on Bitcoin and Ethereum, but at the end of the day anyone can read and write to the chain. It also provides pretty strong assurance that data wasn’t changed or deleted. So, with blockchains you can only ever add to them you can never actually delete a block from the chain. And once a block has been added you can’t change it. If you were to do so, or if you were to try to do so, it’d become very apparent and the whole system basically breaks dowm. So, you can pretty much rely on the fact that if there’s a block that says that Alice sent Bob five tokens, she did that. That’s not necessarily true with, again, your bank or your government. There’s certainly regulations and laws and things that would certainly discourage a bank from just forging transactions in their system, but they could technically do it if they wanted to do it. But then there’s the question: alright, so what’s the cons of crypto? This sounds great, but when we’re talking about technological solutions we need to look at both sides of the coin. There’s a pretty long list of cons when it comes to blockchains. They’re really slow. They’re really, really slow. Bitcoin does, I think it’s seven transactions per second. Which is nothing compared to Visa or very similar systems. Ethereum’s a little faster, but not much. And so when you’re talking about using this at the web scale, you start to run into problems with speed. It’s also very expensive. So, not only is crypto—you know, the Bitcoin or Ethereum, buying one or two of those can cost a lot of money—but in order to do anything on the blockchain—just send money—you have to pay for the transaction costs, and those can be very expensive and they certainly add up. It’s difficult to scale for the same reasons I mentioned, and it’s also really difficult to use. If you are trying to keep control of your own tokens rather than use a centralized wallet provider like Coinbase or something like that—and all crypto people will tell you that you should hold your own crypto, it’s the only way to do it and it doesn’t count if you’re storing it with Coinbase—that’s really hard to do. You have to basically become the security branch of a bank to do that. Even I, a software engineer, find it challenging. It’s difficult to do, there’s a lot of risk if you have a lot of money stored that way. And then, privacy largely relies on pseudonymity. So I mentioned this earlier: imagine if your checkbook statement was basically on a public database. That’s exactly—that’s literally true, that everyone can see your transactions, they can see that you sent money to a different party, and so you basically have to rely on people not knowing what your wallet address is in order to stay private. Which is a lot more difficult to do in practice than it is in theory, I would say. There’s enormous exposure to price volatility. So if you are building software on something like Bitcoin or Ethereum, and then the Bitcoin price—or, more like the Ethereum price, because Bitcoin is not really a software platform—if the Ethereum price doubles then all that money that you were paying to do transactions and run your software also increases. And it’s also very prone to volatility based on usage, so the more people who are trying to do transactions on Ethereum at once, the more it costs to do a transaction. There were some cases where transactions were costing hundreds of dollars, thousands of dollars even, because of congestion on the network. And finally, changing code and patching bugs is really difficult. So, I mentioned before that you can only ever add to the chain, you can’t delete from it or change blocks. That includes code that is being run on the chain. You can’t actually go in and patch a bug if there’s some flaw that allows people to just siphon all the money out of your project, you have to just release a new version of your project and then convince everyone to move over to it. Which is not the most smooth experience, and it means that the money in your previous project is probably all gone by the time you get the chance to do that. All of these things have, people have techniques that they have used to try to overcome them, but these are sort of the fundamental issues with the technology that then they sort of have to Band-Aid with other solutions to try to surpass them.

There are some claimed use cases for crypto. A whole lot of them. And I’m not going to go through them one by one, but: they say it’s a store of value, it could be an alternative in countries where the currency is enormously unstable, it could be used for remittances and cross-border transactions—you know, sending money back to your family in some other country. “Banking the unbanked” is a really big one—saying crypto will provide financial inclusion. Moving away from the web’s advertising model, provenance, decentralized governance, own your own data, real estate… I mean, people will say a whole bunch of things. Often not a whole lot of details around how they will solve these problems, but there are a lot of problems that they claim to be able to solve.

There are some more believable use cases, I would say. So, the big one, and I mentioned this before, is censorship resistance. This is another slide from a16z—Andreessen Horowitz, that is—who are condemning Big Tech, which is a little bit ironic because they’re a venture capitalist who funds a lot of Big Tech, including Facebook initiatives, so it’s a little weird that they’re calling them out on the slide… but who am I to judge? They have big talk around how crypto will end digital authoritarianism and Big Tech oligopoly, and that’s also not really been the case in practice with their projects, which tend to centralize very much and are again enriching venture capitalists. But it is true that if you need censorship resistance from the state, from your bank, from your software provider, cryptocurrency does at least try to achieve that. Whether or not a given blockchain is actually censorship resistant or not is kind of a different question, but in theory, that’s a possibility.

Another use case would be speculation. If you want to gamble on a crypto token, you can definitely do that. This is the Dogecoin chart. If you bought Dogecoin in February 2020 and held it and sold it in maybe April, you’d be doing pretty well. Some people did that and made a ton of money… and then have to explain to their family how they made money on “Dogecoin”, but sure enough that is possible. Unfortunately there’s the other side of that, which is that if you read about all these people who made a ton of money on Dogecoin and decided to buy Dogecoin in April, you’ve probably not been doing so well since then. But if you feel like to speculate on volatile assets crypto might be for you.

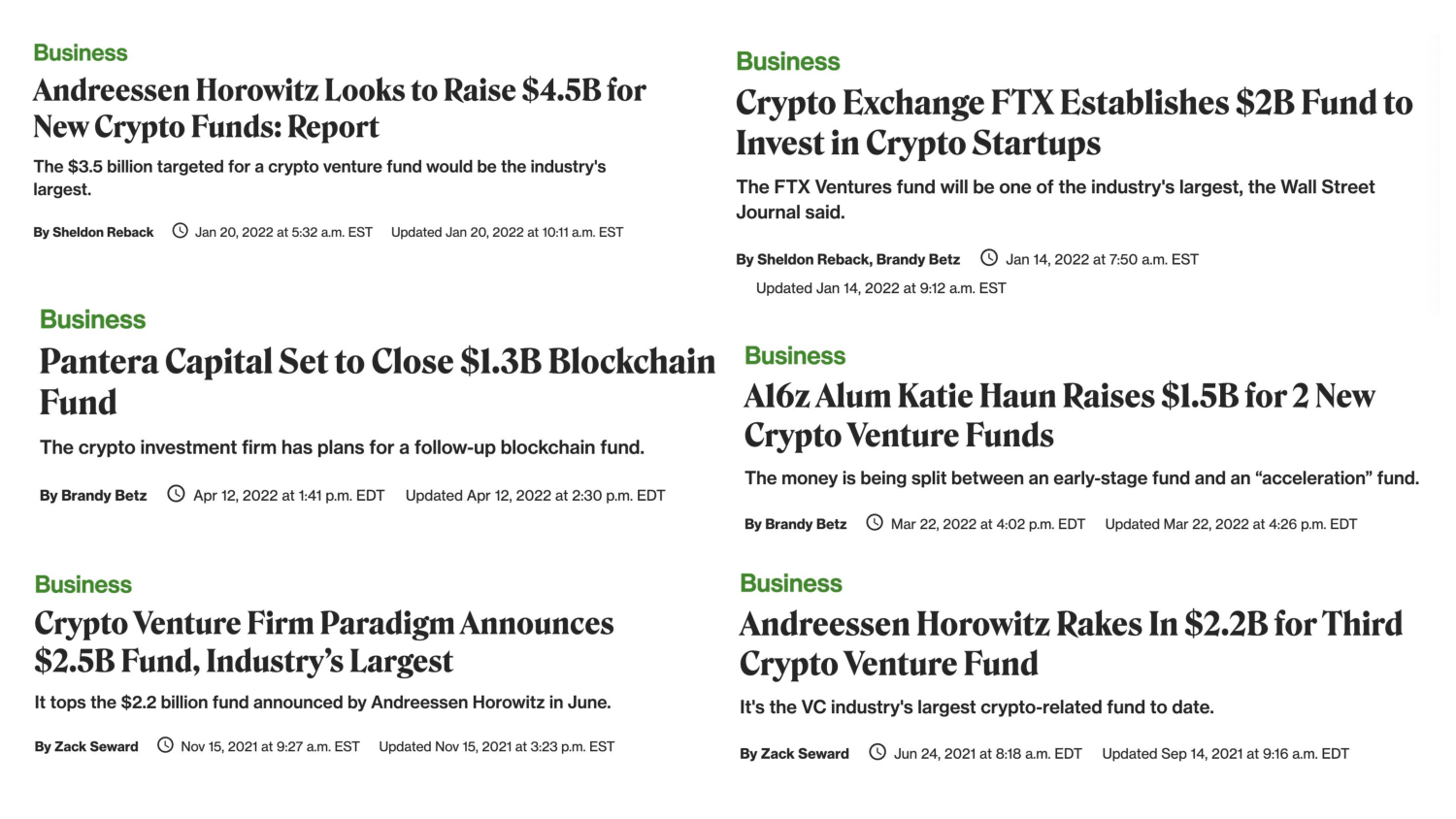

And then the biggest one, in my opinion: crypto is like catnip for venture capitalists. If you are creating a startup and you need funding, just tell them you’re going to use a blockchain and you are golden. That, I think, has been one of the biggest drivers of crypto and the web3 phenomenon: that billions and billions of dollars are going into it from venture capital firms. I mean, it’s just shocking amounts of money. So, in my opinion, those are sort of the more reliable or believable use cases for crypto.

But in my opinion, crypto and blockchains and web3 is mostly a solution looking for a problem. There’s this saying that if you’re a hammer, everything starts to look like a nail. There’s sort of a phenomenon in the tech world, especially in the past year or two, where people have basically been saying “alright, we need a blockchain. We’re going to use a blockchain, what can we do with it?” And so they start to sort of cast around, and they say “poverty” or “world hunger” or “cross-border transactions and remittances” or “social networks”… and they sort of start to try to look for something that a blockchain could potentially be applied to. It reminds me a lot of sort of… maybe 10 years ago? My timeline is probably off. But when Uber was really getting big and the big joke was everyone was trying to do “Uber, but for something”. You know, it was the gig economy boom, and so everyone was like… “Uber, but for your laundry!” or “Uber, but for taking care of your pet!”, you know, “dog walking!” And people were coming up with these startups and they were being hugely valued because they were kind of like Uber. And that’s sort of what’s happening today except it’s “dog walking, but on the blockchain!” or “insurance, but on the blockchain!” At best, a lot of them are just kind of silly, you know? It’s like… why does a dog walker need a blockchain, come on, that just doesn’t make sense. But some of them I think can do real harm, especially when you start to get into really serious issues like hunger, for example, or selling crop insurance to African farmers was a big one not too long ago. And there’s actually real people at the other end of that who need food or they need the assurances that they’ve been given around their crops, and if those projects fail or something goes really wrong, they can really end up getting the short end of the stick.

This is a good illustration of some of the problems—quote-unquote “problems”—that people are trying to solve with crypto for some reason. There’s carbon offsets, there’s putting your DNA on the blockchain and then selling that, I guess. Dating apps on the blockchain. Social networks. Starbucks on the blockchain! You can get an NFT now if you are part of the loyalty program. You can get crypto just for walking around! Not really sure, I still haven’t figured out what the business model is there, but that’s a pretty cool one if you’re the one walking around, I guess. NFTs for books and publishing! So, this has sort of been the past couple of years in the crypto world.

We really run into something that is broadly known as the XY problem. If any of you have ever used Stack Overflow, you might have run into this. Generally speaking, the idea is asking “how do I do Y?” You know, “how do I use a blockchain to solve world hunger?” Rather than “how do I solve world hunger, and what’s the way to do that?” So people have basically been trying to find the solution rather than the problem. There’s a good example of the XY problem where someone was receiving complaints around elevators. People were waiting around, the elevators were really slow, they were really bored, and they were complaining about elevators. And so they started to figure out, okay, how can we make the elevator faster? But the real problem was that people were bored, and so what they ended up doing was installing mirrors in the lobby, and people got to admire themselves in the mirror and give them something to look at, and the complaints went down dramatically and they didn’t have to do anything to the elevators. There’s another good example of this where if you go… you know, you’re at a hotel, you’re in a different country, and you go and ask “is there a convenience store nearby?” They might just say no, and then you’re kind of out of luck. Whereas if you say if you look at the actual problem, which is “I forgot to pack my toothbrush”, you know, “I need something simple like that”, they can say “well no, there’s no convenience store, but there’s a gift shop” or “there’s a supermarket” or there’s something like that and you’ll actually have a better chance of solving your problem. This comes up a lot in crypto, where people are saying “how can we use a blockchain to do X?” when they’re not asking “how can we do X?”

A good sort of philosophy for trying to solve problems like this is going, “well, what’s the actual problem you’re trying to solve? Why does that problem exist in the first place?” And then, “what solutions might address the actual issue, and what are the trade-offs of those solutions?” This is sort of the standard model in software engineering, but I would say it’s kind of the standard model in most industries for trying to solve problems, and for some reason it’s sort of been turned on its head. I say “for some reason” as though the enormous amount of venture capital funding isn’t sort of the clear reason.

So we’ve seen this in reality a few times. For example, asking “how can we introduce Bitcoin to El Salvador?” So if you ask that question, well, you can make it legal tender alongside the dollar which is the current currency in El Salvador. You can have the government create a Bitcoin wallet app that everyone can easily download. You can give people $30 in Bitcoin if they download that app. And there you go, you’ve got Bitcoin in El Salvador. And that’s exactly what they did! They weren’t looking, in my opinion, at the actual question of, “well, why do you need Bitcoin in El Salvador? What’s the problem you’re trying to solve?” One of the problems they’re trying to solve is, well, it’s expensive and slow to send remittances and El Salvador gets 20% of its GDP via remittances, which is a huge amount. So, “how can we make it easier for people to send remittances?” And sure, you could say “well Bitcoin!” That’s a solution. But you should also ask, “well what’s the trade-offs of using Bitcoin?” Now people are exposed to Bitcoin’s volatility and risk. So when El Salvador rolled out Bitcoin as legal tender it was at $45,000. Now it’s under $20,000, so anyone who decided to put money into Bitcoin at the advice of their president is down over half. People have to try to cash out this Bitcoin to spend it on food or rent or whatever it is that they’re actually trying to use it for. People who are in the U.S who are—Salvadoreans in the U.S who are—they have unusual immigration status, they’re not documented, they can’t necessarily use it very easily because they need a bank account to do it. And that’s a fair number of people. Bitcoin is also slow and expensive, just like remittances, especially with the Chivo Wallet, which is what’s being used in El Salvador, which can hold on to your Bitcoin for indeterminate amounts of time. So they’ve had this situation where they’ve tried to solve the problem Y rather than attacking the problem X: why is it slow to send remittances? Well, there’s regulations there. You have to make sure that you’re not sending money to someone on a terrorist watchlist, that they’re actually a real person. And there’s there’s certainly serious issues with remittances. There’s bloat in the financial system, there are technological improvements that can be made to smooth that, there’s improvements in the regulations that could be made. But you do sort of need to consider those potential things before just saying “well what about Bitcoin?”

So here’s another good problem: people are asking “how do we make blockchains and crypto safer, easier to use, less expensive to use, faster?” when I think the real problem is that people are falling victim to these predatory schemes because venture capitalists and crypto evangelists are convincing them it’s the future of the web, it’s the future of finance, it is the solution to trying to create generational wealth and escape difficult inflation or earn returns on their investments that are not available to them in the traditional financial system. If you look at problem two, my solution to that problem, at least, has been this website: Web3 is Going Just Great.

This is a project that I run, and what it really does is it just keeps track of, “well how is web3 going? How is this project that claims to be able to revolutionize the web, increase equity to financial systems, solve the issues of advertising and lack of privacy online, how’s it going?” Generally speaking, it hasn’t been going so well.

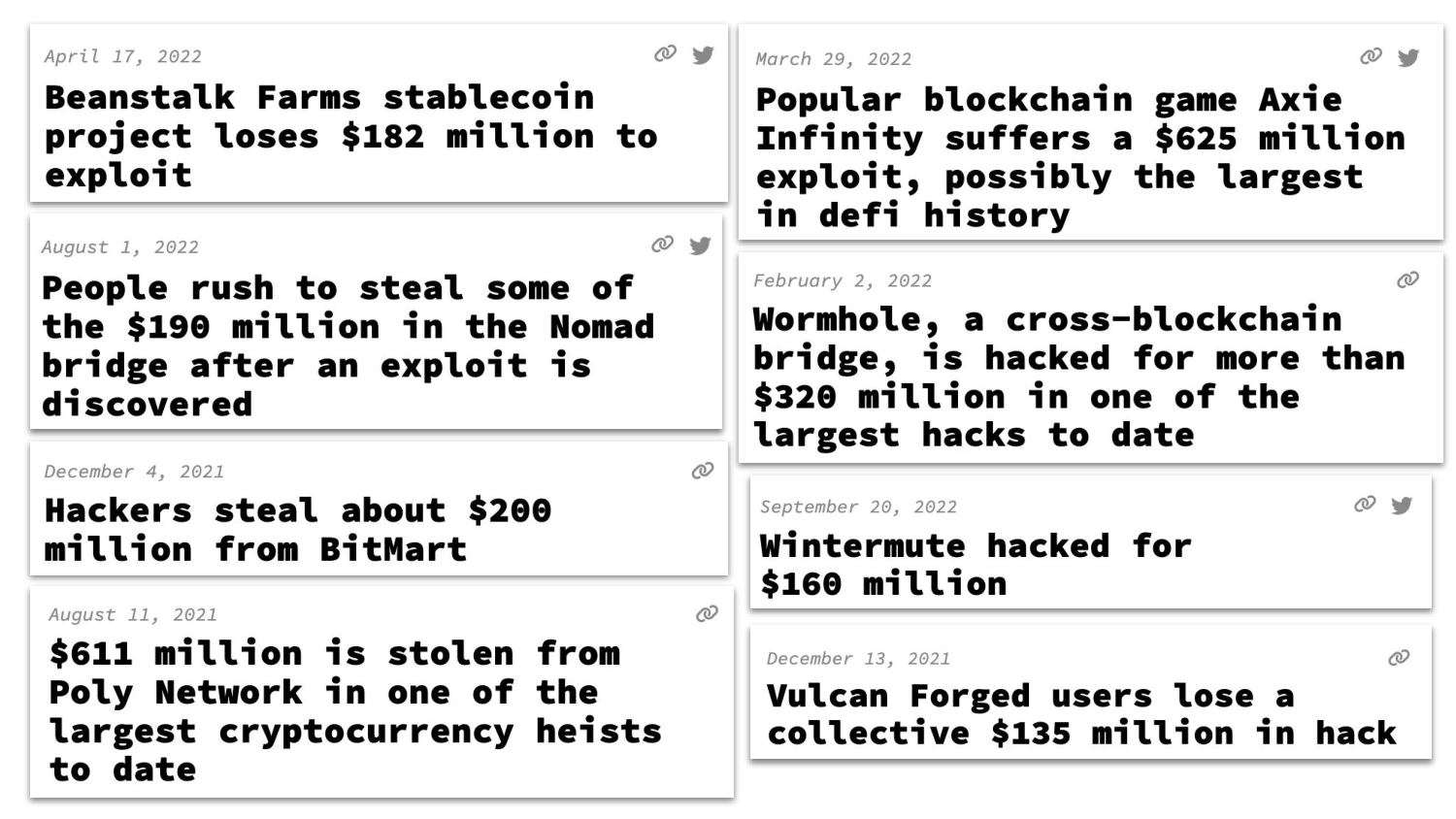

There have been multitudes of examples where the security issues that are fairly inherent to blockchains and cryptocurrency have resulted in hacks of more than $100 million. These are all more than $100 million, and these are all in the past… I was going to say two years, but I think it’s actually more like one year. I think the earliest one is August 11th here. So just enormous, I mean enormous, amounts of money being stolen. Sometimes it’s the venture capitalists who take the hit, more often it’s the people who are just putting money into these things as a retail investor.

And then there’s other examples of things that are happening in web3 as well which are not necessarily the $100 million hacks, but… it’s sort of the rake thing. You know, when someone steps on a rake? It’s examples of things happening that are so typical of crypto and web3 and blockchain-based systems that you almost have to laugh at it. Bill Murray’s NFT charity auction earned over $100,000, just amazing stuff. And before they could give it to the charity, it was stolen because his wallet got hacked. A crypto scam watchdog group that was trying to help identify other crypto projects that might be scams, they got scammed. They got exploited, but that’s the whole thing that they’re trying to prevent. Someone, a developer, ran the wrong command. Instead of typing one thing they typed the other thing, and they closed the project contract, and it meant that the $600,000+ that were in that project… just gone. No one can get it. You can see it’s there, but you can’t get it anymore. And so everyone using that project is just out of luck. Someone tried to swap $5 and they ended up… it’s like if you went to your bank, and you put a five dollar bill into the ATM, and then the little screen said “alright, you’ve got $10 trillion in your bank account.” Imagine if that happened. Needless to say the user did not actually have $10 trillion, that would have like destabilized traditional finance if that kind of money was floating around, but it said they did. A carbon offset company that was trying to help with the environmental situation, help people feel better about their environmental impact, they started a forest fire in Spain that ended up spanning over 35,000 acres. And it was the second one that they’d started that month. Then in November, Squid Game? Huge TV show, everyone loved it. People were so excited about Squid Game that they bought into this big Squid Game token which had no affiliation with the Netflix series, nothing to do with the original thing, and everyone involved in it just made off with $3 million because that was how excited people were to buy this new Squid Game token hoping that it might be the next Dogecoin, the next Shiba Inu, the next Elon Musk token that would make them overnight trillionaires.

So, needless to say, I think that the the attempt to use technology to solve problems that in some cases are very serious and very real problems—you know, access to banking, authoritarian governments, people being able to send money on the Internet in a reasonable way, these are real problems—but saying “alright, we’ve got a blockchain how can we solve them?” has really not been going so well. I think, just to conclude, it’s important to realize that there are basically never purely technological solutions to societal problems that crypto and other technologies are trying to solve. Sometimes technologies can be a part of the solution, but generally speaking you can’t just say “well the financial system has problems, so we’re going to make a whole new financial system, and oh by the way, you can’t change anything in it and if someone steals your Bitcoin they’re gone forever” and expect that to just be a sudden improvement over the traditional financial system which has years of development and regulation baked into it.

Questions and answers

Is crypto over? It seems like there hasn’t been as much appetite for it lately.

I think this chart here is maybe a good example of what tends to happen in crypto.

This is a Bitcoin price chart since its inception. Basically when it started it was very very small amounts of money, you know, Bitcoin was ten dollars or something like that early on. And then it had this big big surge in like 2017, you might remember there was a whole bunch of hype around ICOs—initial coin offerings—that instead of going public, every company was just going to release a token and it was going to be amazing. That got people pretty excited for a while, and then the SEC said “well that’s just a securities offering” and so things went back down a little bit. And then they sort of just went along for a couple of years until 2020, which was NFTs and web3 and all these new and exciting potential uses for crypto. We’ve hit sort of the the hype tops in 2020 and then again in 2021, and more recently people have been less excited about NFTs and it’s like “the stupid apes”, you know? There’s less of a societal willingness to accept those. Also with just the sort of traditional financial system not doing as well, you know, stocks have been down, there’s been less appetite for these crazy investments and “walking your dog on the blockchain”, so things like that have been down. But crypto and… actually I didn’t point it out but there were other sort of smaller hype cycles back in here that have sort of been blown out of the water by the more recent ones. Crypto just follows these sort of cyclical patterns, where people get really excited about something, something sort of new comes along, whether it’s NFTs or ICOs or web3 or whatever it might be, people get crazy excited about it and then it just becomes unsustainable or something happens and it just crashes right back down again. I think we’re kind of doomed to repeat that unless there is a significant regulatory change that would actually crack down on the fact that, hey, these tokens look a lot like securities and you really actually have to comply with the traditional regulation that securities have to go through, which might dampen some of the excitement around it and stop these crazy hype cycles from happening. But I think when people see the price crash like it has and they go “crypto’s dead, blockchains are dead, the hype is over”, I think that’s maybe a little too optimistic. I mean, some people would call it too cynical, I would call it too optimistic. People love to speculate on this stuff, they love to come up with new ways of using cryptocurrencies to sidestep securities regulations, or anti-money laundering laws is another big one that that they get around by using crypto. People will always come up with new ways of using it, and I think it’s it’s likely that that will happen again. Please don’t buy crypto based on that, that’s not financial advice, etc.

Are there any good uses for blockchains?

Yeah, it’s a great question. One thing I will say is—I am not a big fan of crypto, obviously—that’s not to say there have not been instances in which crypto has really helped some people. Some people have become overnight millionaires and that’s great for them, obviously. They’re they’re not going to be upset about that. There have been instances where, for example, there were large donations to Ukraine when the Russian–Ukraine invasion started. That’s obviously, I think, only a good thing regardless of whether or not they use Bitcoin or not to do it or a million other cryptocurrencies. There are some examples where people have tried to flee authoritarian regimes and they put their money into Bitcoin and then they haven’t had it confiscated at the border. All these different things. Generally speaking, my opinion on this is that crypto’s best use cases are isolated. Mostly because, for example, if an entire, a huge percentage of a country for example all started to try to flee an authoritarian regime using Bitcoin, that authoritarian regime would probably start paying attention and crack down on that. The same way they do if you try to flee with a trunk full of diamonds or cash or gold or whatever else you might be doing. The problem is the authoritarian regime, right? And so you need to find solutions that fit the problem. Is there something that—outside of those examples of very severe circumstances where you need anything that’s better than a really bad situation—is there anything that I think crypto is particularly suited for? I think it works really well for people who are looking for speculative investments, almost as a gambling tool. Obviously the fact that you know Bitcoin generates the same, er, uses the same amount of electricity as like Finland or something like that is probably not great for something that is just gambling. You know, imagine if Vegas used that kind of electricity. They’ve got a lot of lights and stuff so I guess they probably do use a lot of electricity, but it’s not like crypto. But besides that, I think the the actual requirements that are satisfied by a public blockchain—and that’s what I’m talking about here, is these public blockchains where anyone can read anyone can write—fairly few and far between. There are definitely circumstances where you want a database where you can… it’s append-only and you can trust that it’s never been changed in the past. So for example, if you were a bank and hackers got into your system and you want to look over logs of what was happening during that hack to figure out what they did, you want a system where you can trust that the logs weren’t changed or that that bit right in the middle isn’t gone. But there are also a lot of ways of doing that that don’t require a public blockchain. I think the number of problems that are really solved by a public blockchain are pretty minor, pretty minimal, yeah.

What do you think would be some ways to improve the web today, if not crypto and “web3”?

It’s like you plant, er, like I planted that question. That’s actually what I’ve been doing a lot of research into more recently. So I am just a huge fan of the web. It’s a weird thing to say, it’s like “I love the Internet!” And I really do. I think there’s some amazing things that the web has enabled. Wikipedia being a good example, you know, I think everyone’s used that. It’s amazing that there’s just this free repository of information out there that’s fairly reliable, that is just collaboratively created by a bunch of people who aren’t paid to do it. Like, that’s wild. I think if the whole web was like that, that’d be amazing. So yeah, I love to think about like, “okay, so how can the web be what we wanted it to be in the beginning?” When people first started to talk about the web, it was this really utopian idea of everyone can talk to anyone halfway across the world, you don’t need to pay to talk on the phone, you can just hook up your modem, you’ll be able to meet all these people from different cultures, experiences, and I’ll get to share things with you, you’ll get to make friends, you’ll get to run your business with someone halfway around the world, all this really cool stuff. And the web absolutely has achieved some of that stuff. The web is pretty awesome for what it is today. But there’s also a lot of parts of it that are not great. So, for example, the monopolization of the web by just a small handful of tech companies, that’s not great. And one thing you might notice, actually, is if you pay attention to web3, you’ll start to notice that a lot of the things that I’m saying are bad about the web are actually the same things that people in web3 are saying are bad about the web. We actually agree on a lot of the problems. We disagree a lot on the solutions. So, the monopolization of the web, that’s a big one. The prevalence of advertising and the advertising-based model that the web is built on, I think is pretty terrible especially as you start to look into the invasions of privacy that are happening around that. You know, you have to hand over a lot of data. Sometimes by actually entering it into a form, but more often wthout really your knowledge that they’re collecting that data. I think there’s a lot of problems like that. Governance is another big problem, of platforms online. I mentioned Facebook banning you. The crypto solution is, “well, we’ll just create a project where no one can be banned”, right? Ethereum, you can’t ban someone from using Ethereum. I don’t know if that’s really the direction that we should be going, around when you look at online extremism, when you look at… you know, you can look at the really extreme examples like political extremism, child pornography, revenge pornography, all those really awful ideas of why you wouldn’t necessarily want a truly free web where anyone can put anything they want. But you could also look at just the really boring and mundane examples, like imagine if there was no spam filtering on the web, right? Like, “anyone can post to the web”: that means that the people trying to sell you fake purses, and those weird scam replies you get on Twitter if you post anything about NFTs, that’s just everywhere, Twitter can’t do anything about that. So there’s examples of stuff like that, where it’s like, oh boy, I don’t know about that… So as far as what we could do to achieve a more wonderful web, I think it’s a wonderful question. It’s one that I’ve been thinking about a lot. I think that reducing the monopolies would probably go a long way. One of the reasons Facebook sucks so bad is that there just aren’t that many competitors to Facebook, and the reason that there aren’t that many competitors is not because there aren’t people who think they could do a better job, or that could make a social network that people actually want to use, it’s because anytime someone tries to create one, Facebook buys them or they shut them down in some other way, and so they can’t exist to compete with Facebook. Then you end up with these behemoths like Facebook and Google and Amazon and all these other big names that are incredibly difficult to compete with, because they’ve become so big where if you’re sitting in your dorm room dreaming up the next social network you’re like, “boy, I don’t know if I can compete with Facebook…” So I think some changes to monopolization, and actually allowing for proper competitive marketplaces online, basically, would be an improvement. I also think that a lot of the best things in the web come about because people just have the time to do it. One big problem with Wikipedia is, you know, I love to edit it, I spend my free time doing it, I think it’s really wonderful and a great way to give back but also to entertain myself, and I’m able to do that because I have free time that I can spend doing things like that. But there are a lot of people out there who don’t. They work two jobs, or they have a bunch of kids they need to take care of, or they have elderly family members that they’re caring for, or for whatever reason they just can’t take the time to do those things that are really cool and really fun for them. Obviously not everyone in the world would go and edit Wikipedia if they had more free time, but I think that everyone has something that they would do if they had that free time, and a lot of it is societally beneficial. If you look at crypto, the answer to that is “well, we’ll just pay everyone to edit Wikipedia or play a video game or post on a social network”, and that’s the solution. But when you look at how that actually works out in practice, it also means that people have to hold the token, they have to pay to get the token, so now not only do you have to find free time, you have to find the buying costs to do something like edit Wikipedia or play a video game. If you look at Axie Infinity, which was the biggest crypto blockchain game until it was spectacularly hacked and things sort of fell apart then—by North Korea, by the way—in order to start playing Axie Infinity, you had to pay a couple hundred dollars to buy your little Axie character which then you would sort of battle against other Axies in sort of a Pokemon way, but way less fun than Pokemon has become or even started out being. So imagine, I mean—buying a $60 video game is already a lot for people, right? Like, that’s what it costs to buy an Xbox game… when I was younger, I don’t even know if it’s true anymore… I feel like an old lady, “what does a video game cost?” If you’re someone who is not in the US, or is not in a developed country where salaries are fairly high, it’s still $300 and that might be your weekly wage. So the whole idea of “we’ll create this better internet by financializing everything” I think has a lot of problems. I’m a bit of a leftist, my vision for the future of the web also involves a future of society where people are able to have time that is not purely spent earning money, and so I think things like universal basic income could go a long way towards creating a web that I think would be really great. Or just improving societal safety nets so that people aren’t having to rely on a job for their health insurance or whatever it might be. I think it kind of comes back around to the main point of this, which is that it’s really hard to come up with a purely technological solution to a societal problem, and so in order to fix the web I think we have to fix a lot of society—not just write the next best HTTP implementation or something like that.

It seems like the web3 movement has taken on some of the language of other attempts to improve the web, such as around “decentralization”.

I think a lot of what… a lot of the talk around decentralization in crypto and web3, it often conflates decentralization of computing with decentralization of power. If you look at Bitcoin or Ethereum they’re talking about, well, it’s super decentralized because there are thousands of computers anywhere in the world that are all mining these coins… well, validating now, Ethereum recently changed its model. And that’s decentralized. But you could say that about Amazon Web Services, right? They have datacenters all over the place, and they’re not normally considered decentralized because Amazon controls all the power. It’s all just one company. The same is often true of a lot of crypto projects, where the power is actually quite centralized despite the computing being decentralized. So, yeah, I think that the idea that decentralization is somehow inherent to crypto or to web3 is a very compelling sort of misdirection.

Where can I find the project you shared screenshots of?

The project is called Web3 is Going Just Great. You can find it on the web, it’s web3isgoinggreat.com. Free to take a look at if you like. Basically any variation on the name will get you there, actually. Sometimes it has the “just”, sometimes it doesn’t, you can just put it in. It’s also on Twitter, if you happen to use Twitter, so @web3isgreat on Twitter.

If technology can’t solve societal problems, what should be the role of software engineers going forward?

I mean, I think my ideal scenario would be that more software engineers realize that. I think there is this really strong techno-utopian view among software engineers that we are, you know, God’s gift to this world and we can write software to do just anything. Which, we can write some pretty cool software, don’t get me wrong, but I don’t think we’re gonna fix all ills in society with software. And it would be really cool, I think, if more software Engineers would both acknowledge that and then actually become involved in the societal problems that do really need fixing. Like I said, technological solutions are probably never going to be the solution to a societal problem, but they can definitely be a part of it. I think that there are all kinds of public good software projects that are out there. Focusing on those, I think, is always going to be a good thing. But I would like to think that in the future, software engineers might be taken down just to peg or two around their belief in society being fixed by the programmers. I think a lot of industries fall victim to that. There are writers who think that their ideas are going to be the best solution to all of the world’s problems. Politicians for sure. Everyone, I think, is prone to it.

Disclosures for my work and writing pertaining to cryptocurrencies and web3 can be found here.